Riding on the hallmark of trash to treasure, waste to energy industry has been thriving successfully in recent years, on the grounds of the fact that WTE technology conveniently aids energy generation from waste such as wood, food, paper, and yard trimmings. The adoption of WTE technology will significantly reduce the dependency on fossil fuels, which has been one of the most preeminent benchmarks that global governmental bodies intend to accomplish. The proliferation of waste to energy industry across numerous geographies is quite evident from the myriad developments underlining this business sphere. A recent precedent is that of the Comox Valley Regional District considering the deployment of WTE technology. Reportedly, the British Colombian district aims to harness WTE solutions for solid waste management and recycled power generation, which would subsequently have a marginal but effective influence on the regional waste to energy industry size.

The WTE technology, similar to numerous renewable energy solutions, aims to reduce the emission of harmful pollutants from landfills into the environment, which have been on a significant high lately. A 2015 research report by the Environmental Protection Agency states that close to 116 million metric tons of CO2 had been released in the atmosphere from landfills the same year. In order to avoid non-recyclable materials from summing up in landfills, many countries have been rigorously adopting waste management strategies, which have been depicting appreciable results. In the United States alone, close to 12% of energy is recovered from municipal waste. These shifting trends of generating energy from waste materials are likely to gain mass prominence in the years ahead, which would eventually stimulate waste to energy market share.

The tremendous rise in the diversity and quantum of waste materials has led to an increased awareness about waste management, prompting the requirement of cutting-edge technologies for waste disposal. The rising deployment of these technologies would also have a significant role to play in the growth of waste to energy industry. Furthermore, the robustly growing industrialization and urbanization has led to the generation of copious amounts of residual and industrial waste accumulation. In order to deal with the abundance of piled up waste material, major energy firms have been taking initiatives to generate energy from waste, which would have a massive impact on the overall waste to energy market trends.

A concise glance at the contribution of energy giants toward waste to energy industry size

NTPC Limited

The National Thermal Power Corporation Limited, one of most prominent Indian power generation companies, has recently called upon tenders from domestic and international developers with an aim to build 100 WTE (waste to energy) plants across the country under the Swatch Bharat Mission. NTPC aims to scout for developers who have a successful track record in the commercial operations of waste to energy technology with the capacity to process 300 tons of waste per day, for ensuring uninterrupted, seamless operations. The company has already commenced sourcing developers for the multi-million project, that has been touted to have a commendable impact on waste to energy market share. Lately, two UK based waste to energy industry giants, namely, GJ Eco Power (GJEP) and GJ Nature Care & Energy (GJNCE) have offered a proposal of around USD 233 million to set up WTE plant incorporated with advanced technology in various cities across South India. NTPC’s efforts are remnant of the shifting focus of the Indian government to procure most of the electricity from WTE projects – a paradigm shift that may considerably impel India waste to energy industry trends over the coming years.

Hitachi Zosen Inova (HZI)

The renowned Switzerland based waste to energy market player, HZI (Hitachi Zosen Inova) has been chosen for an Australian project by the Eastern Metropolitan Regional Council (EMRC) in Perth, Australia, to process municipal waste for power generation. The plant has been projected to be endowed with processing capacity of 300,000 tons of waste per annum, through which the plant would plausibly generate 28 MW of electricity, sufficient enough to fulfill the power requirement of around 360,000 homes. This 400-million-dollar WTE investment is likely to have a major impact on the regional waste to energy industry outlook, given that this plant will help upgrade Australia’s energy grid, in addition to contributing toward improving the livelihood of the local populace with lucrative job opportunities. It is prudent to mention that HZI’s patented moving grate combustion technology has already been implemented in more than 500 projects globally – a fact that indicates the immense contribution of this company toward waste to energy market.

Suez Environnement

The French energy behemoth has already carved a name for itself in waste to energy industry. Recently though, the company was chosen to sign a 300-million-euro project with the Belgrade city government, that has been focusing on the deployment of a new waste disposal infrastructure, considering the hazardous effects of landfills. The Belgrade city government has inked a public-private alliance with Suez, in accordance with the European standards related to recycling policies, to process the urban waste at the Vinca landfill. Under this partnership, Suez would be liable construct a WTE facility to produce 80 MW of electricity and heat, which would help close the Vinca landfill, thereby impacting the regional waste to energy market size.

The aforementioned precedents highlight the fact that the increasing demand for WTE technology across the globe are certain to encourage companies to install more and more WTE facilities, that would have a rather profitable impact on the overall waste to energy industry share. Furthermore, these biggies have also been attempting to innovate technologies considering the parameters of efficiency and cost-effectiveness, which would considerably transform waste to energy market trends.

Briefing the significant role of globally renowned bodies influencing waste to energy market outlook

The European Union (EU)

In December 2015, the EU revealed an action plan focusing on waste prevention, recycling, and reusing for sustainable development across Europe. In order to comply with this mega action plan, many of the member nations of the EU, such as Germany, UK, Italy a nd Sweden have been consistently adopting contemporary technologies for waste management. In fact, Sweden is one of the most proactive countries that recuperates most of the energy from each ton of waste material in the WTE plants. Acclaimed governmental bodies across these countries have enforced legislative norms as well, in a bid to reduce greenhouse gas emissions sourced from landfills. The dedicated participation of regional governments with regards to the adoption of WTE technology for renewable energy generation thus, would emerge as one of most effective driving forces of Europe waste to energy industry size, which, as per estimates, will surpass a revenue collection of USD 2.5 billion by the end of 2024.

The U.S. Environment Protection Agency (EPA)

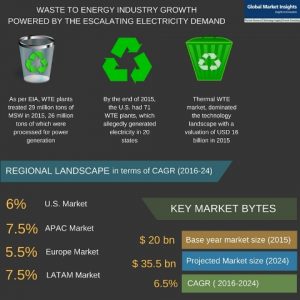

The U.S. is one of the most zealous regions partaking in the overall waste to energy industry share, propelled by the efforts of regulatory bodies in the nation. Recently for instance, the U.S. Environment Protection Agency (EPA) released the updated strategies for waste to energy projects to minimize the emission levels and upgrade the energy capacity. In 2015 alone, U.S. housed around 71 WTE plants in 20 states, with total power generation capacity of 2.3 GW. Out of these, Florida apparently accounted for over 20% of the total electricity generation capacity. The local governments of the United States are thus, undertaking stringent initiatives to install WTE facilities for MSW (municipal solid waste) management, which would certainly fuel U.S. waste to energy industry size in the ensuing years.

The extensive R&D activities undertaken by energy giants to brainstorm state-of-the-art technologies for waste management are certain to lucratively impel waste to energy market outlook. In a bid to reduce the dependency on fossil fuels & natural gas and subsequently minimize carbon emissions, regional government bodies have been shifting their preferences to energy developed from alternative methodologies. On these grounds, it is prudent to mention that two of the most prominent waste technologies circulating across waste to energy industry are pyrolysis and gasification. The surging deployment of these technologies for electricity generation, cite experts, is one of the most essential drivers of waste to energy industry. Considering the immense potential of these technologies to drive combustion engines and turbines, waste to energy market participants have been upgrading their research and development facilities to come up with sustainable solutions for energy development. In effect, the combined efforts of authorized bodies and energy firms to increasingly promote the commercial applications of WTE technology are certain to bear fruit, as waste to energy industry is forecast to garner renewed traction in the forthcoming years. Global Market Insights, Inc. estimates the global WTE market valuation to surpass USD 35 billion by 2024.

Global Market Insights, Inc. has a report titled “Waste to Energy (WTE) Market Size By Technology (Biological, Thermal [Incineration, Pyrolysis & Gasification), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, France, Italy, Sweden, China, India, Japan, South Korea, Australia, Thailand, Indonesia, Malaysia, Philippines, Argentina, Brazil, Chile, Kenya, Nigeria, South Africa, Qatar), Application Potential, Price Trend, Competitive Market Share & Forecast, 2016 – 2024” available at https://www.gminsights.com/industry-analysis/waste-to-energy-wte-market